Table of Content

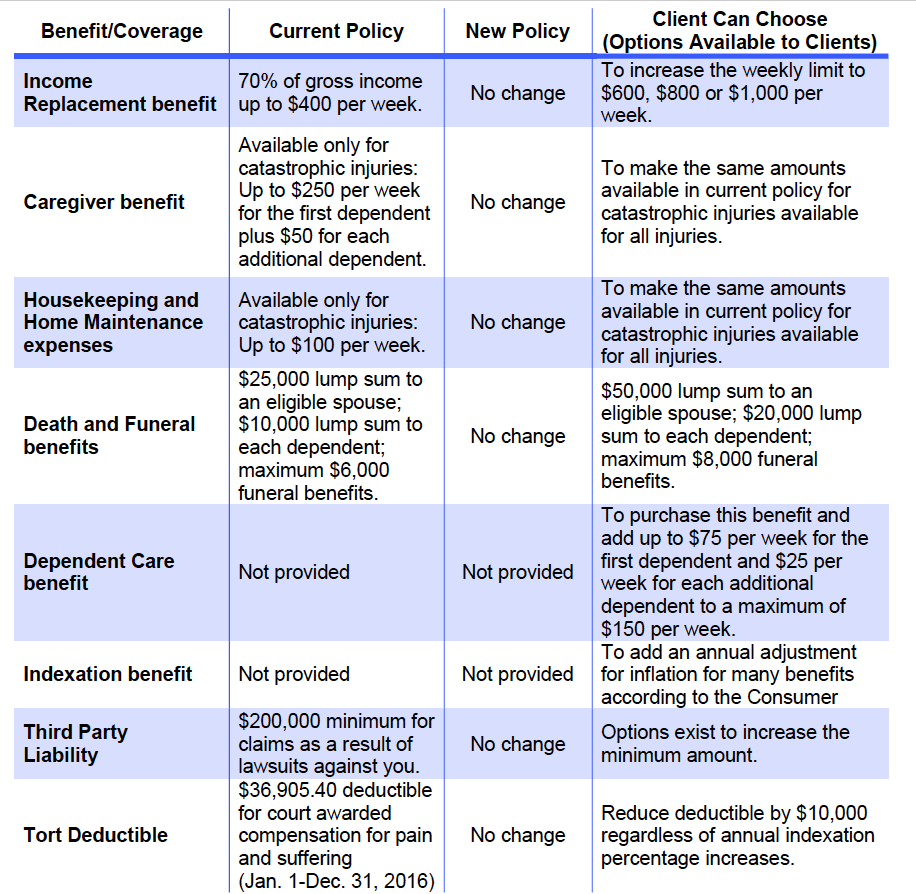

Onlia has taken the guesswork out of car insurance — all policies include provincially mandated coverages, plus extras at no additional cost. A multi-policy discount is generally the same as an insurance bundle – by purchasing more than one policy from a single insurer, you can bundle your products together and receive a lower coverage rate. Combined, the basic package will cover you for a variety of situations you may encounter out on the road. Depending on your needs as a driver, and the budget you have for your car insurance, you may want to consider further protection .

Denise followed up, as promised and sent documents as promised . I was able to e-sign quickly and easily, and Denise sent the temporary pink slips. I am truly impressed and will be calling her when it's time to manage our house insurance. Most insurers provide multiple options for combining different types of insurance.

Home insurance advice

Our licensed insurance experts are here to help – by phone, chat or email. Many Canadian homeowners refinance their mortgages in an effort to reduce their monthly mortgage payments. While electric vehicles technology has been around since the 1800s, EVs only became particularly popular with the introd... You can still be convicted under the Criminal Code and the Highway Traffic Act, and you can also be sued by the injured party for damages that exceed the limits of your insurance benefit. That said, 100 customer responses to specific questions about service are probably more reliable than 12 Google reviews. But all these sources can help you paint a full picture of what a given company can deliver.

Insurance premiums are based on previous claim history, so the more likely the vehicle is to be stolen or in an accident, the more you'll pay for insurance. The coverage and add-ons you choose might cost more but can provide you with additional benefits that could save you money in the event of an accident. We offer competitive rates and coverage options across a range of trusted providers. Explore a range of additional important auto insurance coverage to protect your vehicle, recommended by RBC Insurance. They’re a direct insurance company that offers both home and auto insurance throughout Ontario.

Personal liability home insurance policy

One of the fastest, simplest ways to reduce your premiums are to combine them together. Bundling you home and auto policy together with the same insurance company lowers your costs. The Financial Services Regulatory Authority of Ontario ensures that insurance providers’ rates are fair and not excessive. They also protect your rights when you buy car insurance or renew your policy. Like auto insurance, there are numerous home insurance providers for Ontarians to choose between, and because they each offer different rates, it’s important to shop the market before making your decision.

Learn about what they are, why you need one, the details they provide, and how to get a free car history report. Insure your home with your car, motorcycle, or recreational vehicle and save more. With the TD Insurance Mobile App, you'll receive step-by-step guidance through the claims process, be able to take photographs, and track the status of your claim. Insure all your cars with us so you can make the most of our multi-vehicle discount. Your carmake, model, and year are taken into consideration when quoting you a price. The kind of car you have determines its value, safety features, and how much it would cost to repair damages.

Economical Home Insurance

You’ll be paying a larger portion of the cost if you get in an accident, but the monthly premium will be lower. In 2019, Ontario began enforcing new rules around distracted driving. As you gain a longer driving history in Canada, you'll be more likely to secure a lower rate. We recommend that you comparison shop for a lower rate every time your policy is up for renewal.

They have also teamed up with a number of reputable insurance providers, including Intact and Optimum. In the first step of application, you'd be asked some basic questions about your health and the coverage options you're interested in. Yes, you can apply for a multi-policy or multi-vehicle discount. One person in the relationship - typically the individual with the most experience and best driving record should be the primary insured individual and policy holder. You can then add the second vehicle policy and second insured individual to your policy.

There could also be medical payments and expenses that you’d be covered for, plus lawsuits along with multiple coverage options to pick from. It does not matter if you are a tenant, a condo owner, or a homeowner, they will have packages available to suit everyone. At Belairdirect Home Insurance, it does not matter what type of home you own because it will offer you the coverage and the discounts that you require.

The appeal of bundling is that you will receive a major discount and save money. We can help you compare quotes for home and auto insurance bundles from the top insurance companies in Canada. Save more on your home and car insurance when you bundle with ThinkInsure. Are you looking to bundle your home and auto insurance together to save more? Insurance premiums for you home and auto can be one of your biggest monthly expenses.

The minimum coverage you’ll need to put your car on the road is available with even the cheapest car insurance in Ontario. It guarantees you what you need, while also allowing for competitive rates between companies. Or bundle your home and auto insurance in Alberta, Ontario, Quebec, New Brunswick, Nova Scotia, and P.E.I. Coast to coast, we have coverage options tailored for you. Insurance providers recommend rate increases to cover their own costs. For example, in 2022, many providers reflect that the cost of repairing or replacing vehicles is increasing.

They’re also the second largest insurer in Canada on top of being a major financial institution. Getting the best insurance at the best rate is top of mind for most of our clients at KBD. As president of KBD, Curtis aims to simplify insurance for his clients. He’s helped lead KBD to become one of Canada’s fastest 400 growing companies according to the Globe & Mail. Get expert locksmith help whenever your keys get locked in the car or are lost or stolen. And, for specialty keys that require dealership programming, submit the invoice for reimbursement consideration.

It was a smooth process and thanks to him the very next day I was covered. To see if you are eligible, simply start your online quote for residential or car insurance today. Think about removing collision coverage if you drive an older car. This means weighing the cost of collision coverage with the value of your car and chosen deductibles.

Over time, as your needs change, you have the option make changes. To be eligible for auto insurance, you must have a valid driver's license. Insurance companies will look at your prior driving record to determine eligibility and rates. Other eligibility restrictions may arise from past convictions.

Accident Benefits provides compensation if you, your passengers, or pedestrians are hurt or killed in a car accident. Travellers from outside Canada can check with the regulatory body of the province they will be driving in. This covers against fire, theft, vandalism, falling objects, windshield damage and other types of damage, not related to a collision. On top of being a legal requirement, getting the right car insurance protects you and your car in case of any emergencies. So, with car insurance through Johnson, well always be by your sidefrom your work commute on the 401 to your drive up to the cottage in Muskoka.

If you’ve purchased your house with a mortgage, then it’s binding on you to get home insurance because it becomes a requirement to protect your loan. Bundling is when you buy multiple types of coverage, like home and auto insurance, from one insurance company. Combining home and auto insurance might make you eligible for a discount. Increasing rates in 2022 are a contrast to rate trends at the end of 2020 and 2021, when, during the height of the Covid-19 pandemic, car insurance rates in Ontario went down.